Don't let fear stop you from making smart choices about your finances.

Are you afraid of investing in stocks because of potentially making losses due to stock market volatility? Are you unsure whether you should put aside some money at the end of each month because you think you might need to use the funds now?

The key is to just start saving your money now, intending to invest it.

Why Should I Start Investing Now?

Starting early gives you the chance to develop good habits around saving, spending, and investing. There are also ways to protect yourself against losses on your investments, and you will naturally build experience over time.

Let's take a look at four reasons to start investing now.

You'll build your wealth through compound interest

Compound interest is one of those terms everyone knows about, but few people actually understand it, so here's how it works.

Essentially, compound interest is the money earned on money over time. It's not the same as a rate of return, which represents the percentage of how much money you'll be getting in return for every $1 invested.

Let's compare two different scenarios of someone who started investing at the age of 25 with someone who started investing only 10 years later, with the same amount of money each month.

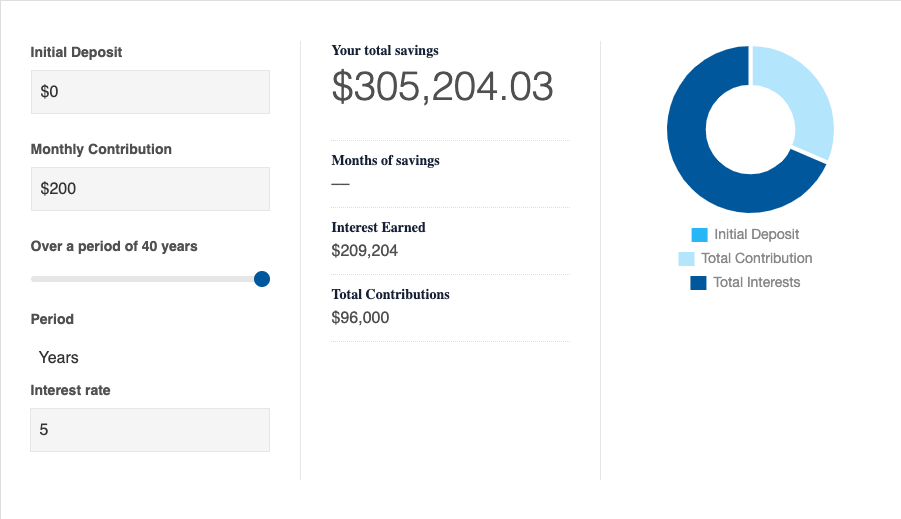

If you are twenty-five years old and put in $200 every month, for ten years, as an investment with a compound interest rate of an average of five percent, then by the time you turn sixty-five, your investment would have grown to $305,204. This assumes no withdrawals are made, and the interest rate is fixed.

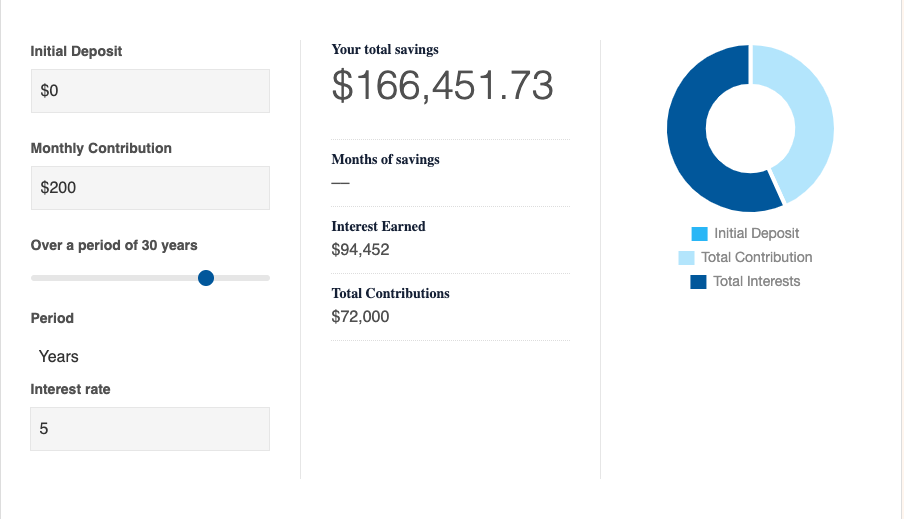

Comparatively, someone who only started investing at the age of thirty-five and invested for thirty years would have amounted to only $166,451 by the time they retire at the age of sixty-five. The difference is a staggering twice the amount of wealth accumulated, with only 10 years difference between the start of the investments.

This shows that, by investing early and benefitting from the power of compound interest, you'll definitely have your wealth well-built by the time you retire!

You can run simulations of how much money you would be able to save with monthly contributions of your choice using our Savings Calculator.

Achieve your financial goals sooner

Have you decided what you aim to achieve out of investing? You can try asking yourself these questions:

- Do you want to retire early?

- Does own property matter to you?

- Are there student loans that you need to pay off?

- Start a family?

You can achieve your financial goal sooner by clearly knowing what you want and how much money it would require.

Be financially secure against inflation

Inflation is a continuing increase in prices over time, which is attributed to several driving forces.

One factor is how much people earn because wages rise faster than prices. Another factor is government spending, which increases the demand for goods and services. The third factor is interest rates. When interest rates go up, banks become reluctant to loan out money, causing businesses to cut back on investments and hiring.

Therefore, when you already have an ongoing investment, you can treat it as an emergency fund and make withdrawals when you have insufficient funds due to inflation.

Have more money by the time you retire

If you invest early enough, especially in a retirement plan, you'll be able to save more money throughout your life. Saving for retirement will allow you to reap the benefits of your hard-earned money in your old age and enjoy financial independence!

Your Future Self Will Thank You

The more money you save now, the less stress you'll face later. The key is to start saving early, regardless of how much you earn. If you're already putting away some cash each month, consider increasing your contributions by adding small amounts over time.

You could seek the help of a financial advisor or various financial institutions to determine an investment strategy and ways to diversify your investment portfolio

by

by